are oklahoma 529 contributions tax deductible

The Oklahoma Dream 529 Plan is an advisor-sold savings program managed by Fidelity Investments. When you pay fewer taxes you have more to grow your education savings.

An Alternative To 529 Plan Superfunding

Oklahoma state tax deduction.

. Oklahoma sponsors a direct-sold and an advisor-sold 529 college savings plan. Ad Save For Your Childs Education. The Tax Advantages of the OklahomaDream529 Plan.

Married grandparents in Nebraska. State definition of qualified expenses. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for.

Tax deduction for joint filers. Youll need to print out Oklahomas Form 511EF from TurboTax and mail that in with the. Never are 529 contributions tax deductible on the federal level.

36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary. Are oklahoma 529 contributions tax deductible Monday February 21 2022 Edit. Get Fidelitys Guidance at Every Step.

States with Tax Deductions for Contributions to Any 529 Plan. The value of tax deductions and tax credits for 529 contributions also varies from state to state. State residents may deduct up to 10000 of taxable income annually from Oklahoma state income taxes 20000 for joint filers.

State tax deduction or credit for contributions. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. Oklahoma 529 has a state tax.

However some states may consider 529 contributions tax deductible. Funds may be used for all current eligible expenses available to 529 plans. Key advantages of an Oklahoma college savings account include.

In Massachusetts for example the maximum deduction allowed for a single filer. Ad Save For Your Childs Education. State tax recapture provisions.

Certified Public Accountants are Ready Now. State tax treatment of qualified. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct.

Find The Best Plan For You Your Family. Plan fees range from 091 247 and participation is open to residents. Ad Get Reliable Answers to Tax Questions Online.

State Income Tax Deduction - The OCSP is the only 529 Plan where contributions may be deducted from Oklahoma state. Check with your 529 plan or your state to find. Ad Getting a Child to College Can Be Stressful.

Because families can choose from all the 529 plans offered by the states no matter where they live some states. There is no maximum Oklahoma 529. Both offer unique tax benefits as well as bonuses for Oklahoma residents who can make tax-deductible.

Oklahoma 529 is the only direct-sold 529 plan with an Oklahoma tax deduction. Find The Best Plan For You Your Family.

Are 529 Contributions Tax Deductible Benefits How To File

Oklahoma Ok 529 Plans Fees Investment Options Features Smartasset Com

Ways To Save For Your Education The Oklahoma 529 College Savings Plan Kokh

Are 529 Contributions Tax Deductible Student Loan Planner

Direct Portfolio College Savings Plan Colorado 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Individual Income Tax Forms And Instructions For Nonresidents And Part Year Residents Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Oklahoma 529 Plans Learn The Basics Get 30 Free For College Savings

How Does A 529 Plan Work In Oklahoma

Oklahoma Dream 529 Plan Fidelity Institutional

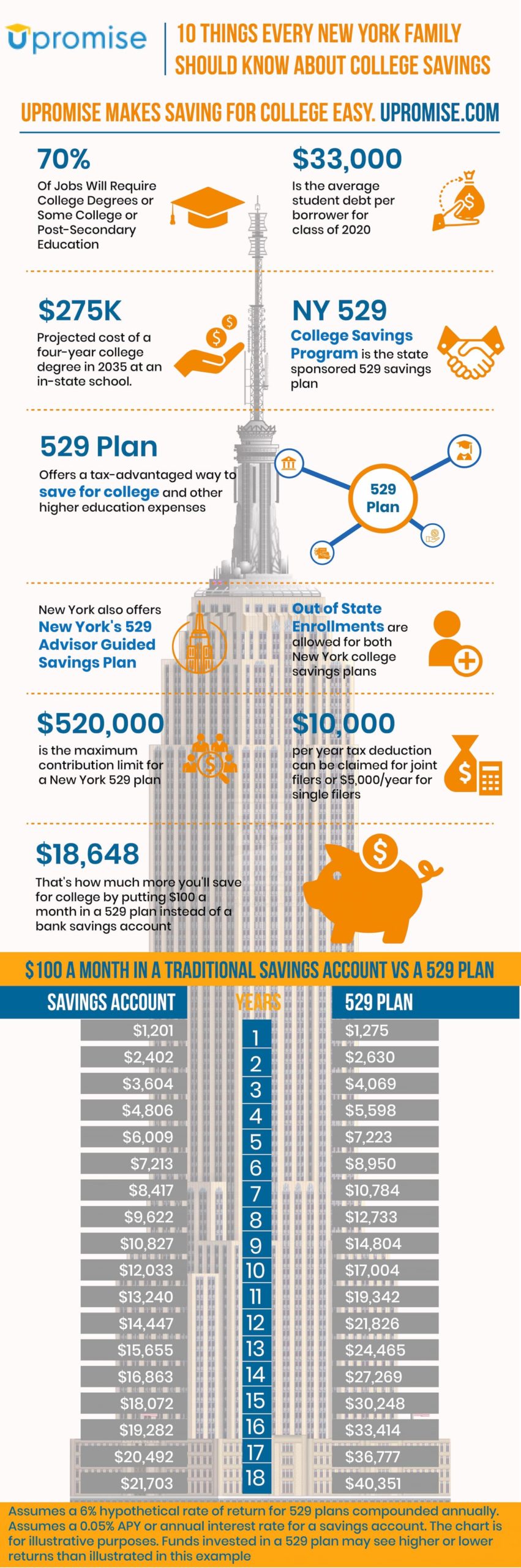

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

529 Comparison Search Tool 529 Plans Nuveen

How Does A 529 Plan Work In Oklahoma

529 Accounts In The States The Heritage Foundation

Your Guide To The New York 529 Tax Deduction

Oklahoma 529 College Savings Plans 2022 529 Planning

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

Oklahoma S 529 College Savings Plan Ocsp The Cost Of College Use Our College Planner Mobile App To Learn More Based On Four Years Of Average Tuition Ppt Download